Excerpt from Regulation E (called “Reg E” for short), which governs electronic fund transfers (EFTs)

TITLE 12–BANKS AND BANKING CHAPTER II–FEDERAL RESERVE SYSTEM PART 205–ELECTRONIC FUND TRANSFERS (REGULATION E)– Sec. 205.11 Procedures for resolving errors.

(a) Definition of error–(1) Types of transfers or inquiries covered. The term error means:

(i) An unauthorized electronic fund transfer;

(ii) An incorrect electronic fund transfer to or from the consumer’s account;

(iii) The omission of an electronic fund transfer from a periodic statement;

(iv) A computational or bookkeeping error made by the financial institution relating to an electronic fund transfer;

(v) The consumer’s receipt of an incorrect amount of money from an electronic terminal; (vi) An electronic fund transfer not identified in accordance with Secs. 205.9 or 205.10(a); or

(vii) The consumer’s request for documentation required by Secs. 205.9 or 205.10(a) or for additional information or clarification concerning an electronic fund transfer, including a request the consumer makes to determine whether an error exists under paragraphs (a)(1) (i) through (vi) of this section.

(2) Types of inquiries not covered. The term error does not include:

(i) A routine inquiry about the consumer’s account balance;

(ii) A request for information for tax or other record keeping purposes; or

(iii) A request for duplicate copies of documentation.

(b) Notice of error from consumer–(1) Timing; contents. A financial institution shall comply with the requirements of this section with respect to any oral or written notice of error from the consumer that:

(i) Is received by the institution no later than 60 days after the institution sends the periodic statement or provides the passbook documentation, required by Sec. 205.9, on which the alleged error is first reflected;

(ii) Enables the institution to identify the consumer’s name and account number; and

(iii) Indicates why the consumer believes an error exists and includes to the extent possible the type, date, and amount of the error, except for requests described in paragraph (a)(1)(vii) of this section.

(2) Written confirmation. A financial institution may require the consumer to give written confirmation of an error within 10 business days of an oral notice. An institution that requires written confirmation shall inform the consumer of the requirement and provide the address where confirmation must be sent when the consumer gives the oral notification.

(3) Request for documentation or clarifications. When a notice of error is based on documentation or clarification that the consumer requested under paragraph (a)(1)(vii) of this section, the consumer’s notice of error is timely if received by the financial institution no later than 60 days after the institution sends the information requested.

(c) Time limits and extent of investigation–(1) Ten-day period. A financial institution shall investigate promptly and, except as otherwise provided in this paragraph (c), shall determine whether an error occurred within 10 business days of receiving a notice of error. The institution shall report the results to the consumer within three business days after completing its investigation. The institution shall correct the error within one business day after determining that an error occurred.

(2) Forty-five day period. If the financial institution is unable to complete its investigation within 10 business days, the institution may take up to 45 days from receipt of a notice of error to investigate and determine whether an error occurred, provided the institution does the following:

(i) Provisionally credits the consumer’s account in the amount of the alleged error (including interest where applicable) within 10 business days of receiving the error notice. If the financial institution has a reasonable basis for believing that an unauthorized electronic fund transfer has occurred and the institution has satisfied the requirements of Sec. 205.6(a), the institution may withhold a maximum of $50 from the amount credited. An institution need not provisionally credit the consumer’s account if:

(A) The institution requires but does not receive written confirmation within 10 business days of an oral notice of error; or

(B) The alleged error involves an account that is subject to Regulation T (Securities Credit by Brokers and Dealers, 12 CFR part 220);

(ii) Informs the consumer, within two business days after the provisional crediting, of the amount and date of the provisional crediting and gives the consumer full use of the funds during the investigation;

(iii) Corrects the error, if any, within one business day after determining that an error occurred; and (iv) Reports the results to the consumer within three business days after completing its investigation (including, if applicable, notice that a provisional credit has been made final).

(3) Extension of time periods. The time periods in paragraphs (c)(1) and (c)(2) of this section are extended as follows:

(i) The applicable time is 20 business days in place of 10 business days under paragraphs (c)(1) and (c)(2) of this section if the notice of error involves an electronic fund transfer to or from the account within 30 days after the first deposit to the account was made.

(ii) The applicable time is 90 days in place of 45 days under paragraph (c)(2) of this section, for completing an investigation, if a notice of error involves an electronic fund transfer that:

(A) Was not initiated within a state;

(B) Resulted from a point-of-sale debit card transaction; or

(C) Occurred within 30 days after the first deposit to the account was made.

(4) Investigation. With the exception of transfers covered by Sec. 205.14, a financial institution’s review of its own records regarding an alleged error satisfies the requirements of this section if:

(i) The alleged error concerns a transfer to or from a third party; and

(ii) There is no agreement between the institution and the third party for the type of electronic fund transfer involved.

(d) Procedures if financial institution determines no error or different error occurred. In addition to following the procedures specified in paragraph (c) of this section, the financial institution shall follow the procedures set forth in this paragraph (d) if it determines that no error occurred or that an error occurred in a manner or amount different from that described by the consumer:

(1) Written explanation. The institution’s report of the results of its investigation shall include a written explanation of the institution’s findings and shall note the consumer’s right to request the documents that the institution relied on in making its determination. Upon request, the institution shall promptly provide copies of the documents.

(2) Debiting provisional credit. Upon debiting a provisionally credited amount, the financial institution shall:

(i) Notify the consumer of the date and amount of the debiting;

(ii) Notify the consumer that the institution will honor checks, drafts, or similar instruments payable to third parties and preauthorized transfers from the consumer’s account (without charge to the consumer as a result of an overdraft) for five business days after the notification. The institution shall honor items as specified in the notice, but need honor only items that it would have paid if the provisionally credited funds had not been debited.

(e) Reassertion of error. A financial institution that has fully complied with the error resolution requirements has no further responsibilities under this section should the consumer later reassert the same error, except in the case of an error asserted by the consumer following receipt of information provided under paragraph (a)(1)(vii) of this section.

Excerpt from Official Staff Interpretation of Regulation E

§ 205.11 Procedures for resolving errors.

(a) Definition of error–(1) Types of transfers or inquiries covered. The term error means:

(i) An unauthorized electronic fund transfer;

(ii) An incorrect electronic fund transfer to or from the consumer’s account;

(iii) The omission of an electronic fund transfer from a periodic statement;

(iv) A computational or bookkeeping error made by the financial institution relating to an electronic fund transfer;

(v) The consumer’s receipt of an incorrect amount of money from an electronic terminal;

(vi) An electronic fund transfer not identified in accordance with §§ 205.9 or 205.10(a); or

(vii) The consumer’s request for documentation required by §§ 205.9 or 205.10(a) or for additional information or clarification concerning an electronic fund transfer,

including a request the consumer makes to determine whether an error exists under paragraphs (a)(1)(i) through (vi) of this section.

(2) Types of inquiries not covered. The term error does not include:

(i) A routine inquiry about the consumer’s account balance;

(ii) A request for information for tax or other record keeping purposes; or

(iii) A request for duplicate copies of documentation.

(b) Notice of error from consumer–(1) Timing; contents. A financial institution shall comply with the requirements of this section with respect to any oral or written notice of error from the consumer that:

(i) Is received by the institution no later than 60 days after the institution sends the periodic statement or provides the passbook documentation, required by § 205.9, on which the alleged error is first reflected;

(ii) Enables the institution to identify the consumer’s name and account number; and

(iii) Indicates why the consumer believes an error exists and includes to the extent possible the type, date, and amount of the error, except for requests described in paragraph (a)(1)(vii) of this section.

(2) Written confirmation. A financial institution may require the consumer to give written confirmation of an error within 10 business days of an oral notice. An institution that requires written confirmation shall inform the consumer of the requirement and provide the address where confirmation must be sent when the consumer gives the oral notification.

(3) Request for documentation or clarifications. When a notice of error is based on documentation or clarification that the consumer requested under paragraph (a)(1)(vii) of this section, the consumer’s notice of error is timely if received by the financial institution no later than 60 days after the institution sends the information requested.

(c) Time limits and extent of investigation–(1) Ten-day period. A financial institution shall investigate promptly and, except as otherwise provided in this paragraph (c), shall determine whether an error occurred within 10 business days of receiving a notice of error. This institution shall report the results to the consumer within three business days after completing its investigation. The institution shall correct the error within one business day after determining that an error occurred.

(2) Forty-five day period. If the financial institution is unable to complete its investigation within 10 business days, the institution may take up to 45 days from receipt of a notice of error to investigate and determine whether an error occurred, provided the institution does the following:

(i) Provisionally credits the consumer’s account in the amount of the alleged error (including interest where applicable) within 10 business days of receiving the error notice. If the financial institution has a reasonable basis for believing that an unauthorized electronic fund transfer has occurred and the institution has satisfied the requirements of § 205.6(a), the institution may withhold a maximum of $50 from the amount credited. An institution need not provisionally credit the consumer’s account if:

(A) The institution requires but does not receive written confirmation within 10 business days of an oral notice of error; or

(B) The alleged error involves an account that is subject to Regulation T (Securities Credit by Brokers and Dealers, 12 CFR part 220);

(ii) Informs the consumer, within two business days after the provisional crediting, of the amount and date of the provisional crediting and gives the consumer full use of the funds during the investigation;

(iii) Corrects the error, if any, within one business day after determining that an error occurred; and

(iv) Reports the results to the consumer within three business days after completing its investigation (including, if applicable, notice that a provisional credit has been made final).

(3) Extension of time periods. The time periods in paragraphs (c)(1) and (c)(2) of this section are extended as follows:

(i) The applicable time is 20 business days in place of 10 business days under paragraphs (c)(1) and (c)(2) of this section if the notice of error involves an electronic fund

transfer to or from the account within 30 days after the first deposit to the account was made.

(ii) The applicable time is 90 days in place of 45 days under paragraph (c)(2) of this section, for completing an investigation, if a notice of error involves an electronic fund transfer that:

(A) Was not initiated within a state;

(B) Resulted from a point-of-sale debit card transaction; or

(C) Occurred within 30 days after the first deposit to the account was made.

(4) Investigation. With the exception of transfers covered by § 205.14, a financial institution’s review of its own records regarding an alleged error satisfies the requirements of this section if:

(i) The alleged error concerns a transfer to or from a third party; and

(ii) There is no agreement between the institution and the third party for the type of electronic fund transfer involved.

(d) Procedures if financial institution determines no error or different error occurred. In addition to following the procedures specified in paragraph (c) of this section, the financial institution shall follow the procedures set forth in this paragraph (d) if it determines that no error occurred or that an error occurred in a manner or amount different from that described by the consumer:

(1) Written explanation. The institution’s report of the results of its investigation shall include a written explanation of the institution’s findings and shall note the consumer’s right to request the documents that the institution relied on in making its determination. Upon request, the institution shall promptly provide copies of the documents.

(2) Debiting provisional credit. Upon debiting a provisionally credited amount, the financial institution shall:

(i) Notify the consumer of the date and amount of the debiting;

(ii) Notify the consumer that the institution will honor checks, drafts, or similar instruments payable to third parties and preauthorized transfers from the consumer’s account (without charge to the consumer as a result of an overdraft) for five business days after the notification. The institution shall honor items as specified in the notice, but need honor only items that it would have paid if the provisionally credited funds had not been debited.

(e) Reassertion of error. A financial institution that has fully complied with the error resolution requirements has no further responsibilities under this section should the consumer later reassert the same error, except in the case of an error asserted by the consumer following receipt of information provided under paragraph (a)(1)(vii) of this section.

Excerpt from Ken Bresler’s explanation of Regulation E (known as “Reg E” for short), which governs electronic fund transfers (EFTs).

>> Be sure to see the graphics at the end.

What the consumer must do

A consumer has 60 days to notify a financial institution of an error on a periodic statement. (Remember that the definition of “error” includes “possible error.”) The 60 days starts running when the financial institution sends the periodic statement, not when the consumer receives it.

The consumer’s notice to the financial institution must:

• be oral or in writing;

• allow the financial institution to identify the consumer’s name and account number; and

• identify the error, and explain why the consumer thinks it is an error.

A financial institution may accept error notices from consumers orally or on the telephone. The financial institution may also require that the consumer notify it in writing within 10 days after the oral or telephone notice.

If a financial institution requires written error notices, it must tell consumers about the requirement and tell them where to send their written error notices.

What the financial institution must do

After receiving an error notice from a consumer, a financial institution must begin investigating “promptly.”

How prompt is “promptly”? Reg E does not define “promptly.”

If a financial institution requires written error notices, it cannot wait for them to arrive before starting the error resolution process. A consumer’s error notice, orally or by telephone, begins the error resolution process, even if financial institutions also require written error notices.

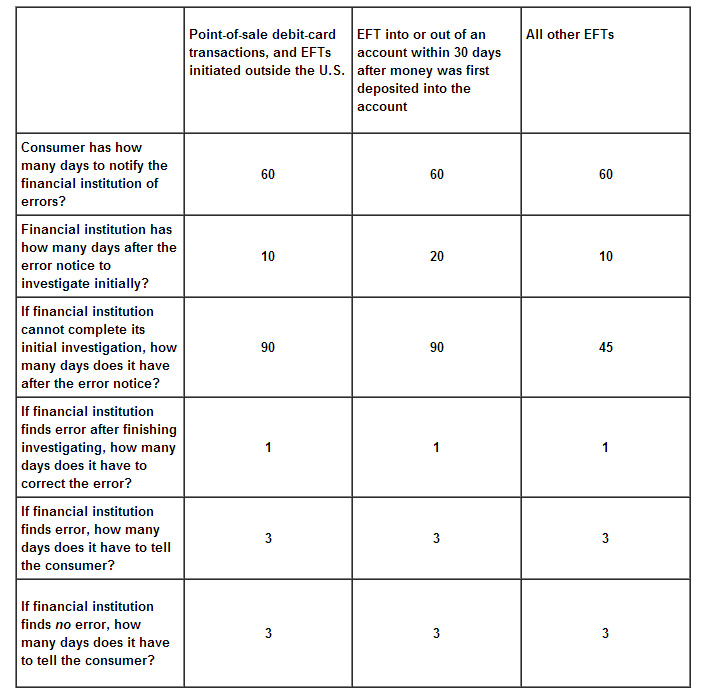

Resolving most electronic fund transfer errors

Reg E has a timetable for resolving errors related to most electronic fund transfers. (It has slightly different timetables for errors related to point-of-sale debit-card transactions and two other small categories of electronic fund transfers. This chapter will discuss them later.)

In general, a financial institution has 10 business days to investigate the error.

If the financial institution cannot finish its investigation within 10 days, it can in general take up to 45 days after receiving the error notice. But the financial institution must do something first. In general, the financial institution must provisionally credit the consumer’s account in the amount of the error, while it continues investigating.

The financial institution must add interest, if applicable. If the financial institution ultimately finds that no error happened, it may debit the consumer’s account for the amount that it provisionally credited the account.

For example, a consumer notifies a financial institution that $150 was transferred to his son’s college-fund money market, but that the consumer preauthorized only $50. If the financial institution needs more than 10 days to investigate, it must provisionally credit the customer’s account for the $100 in dispute.

Suppose that during the extended 45-day investigation, the financial institution determines that no error occurred – that the consumer did authorize a $150 transfer. The financial institution may debit the consumer’s account for the $100 in dispute.

After the initial 10-day investigation, or the extended 45-day investigation, if the financial institution determines that no error happened, it must tell the consumer within three business days. It must explain its determination, and make available to the consumer the documents that it based its determination on.

If the financial institution determines that an error has happened, it must correct the error within one business day, and tell the consumer within three business days of its determination.

Resolving debit-card and foreign-initiated errors

The timetable is slightly different for resolving errors related to:

• EFTs initiated outside the U.S., and

• point-of-sale debit-card transaction.

An example of a POS debit-card transaction is a consumer using her ATM to buy groceries. An example of an electronic fund transfer initiated outside the U.S. is a bank in Europe debiting an American consumer’s account in the U.S.

In general, a financial institution has 10 business days to investigate errors related to these transactions.

If the financial institution cannot finish its investigation within 10 days, it can in general take up to 90 days after receiving the error notice. (For most investigations, financial institutions can take up to 45 days.)

Resolving errors in newly deposited accounts

A still slightly different timetable exists for resolving errors in an account within 30 days after money was first deposited into the account.

Suppose that an error notice involves an electronic fund transfer into or out of an account within 30 days after money was first deposited into the account. Then the financial institution has 20 business days to investigate, not the 10 days it has for most Electronic fund transfers.

If the financial institution cannot finish its investigation within 20 days, it can take up to 90 days after receiving the error notice, not the 45 days it has for most EFTs.

For graphic summaries, see below. Click on graphics to enlarge.